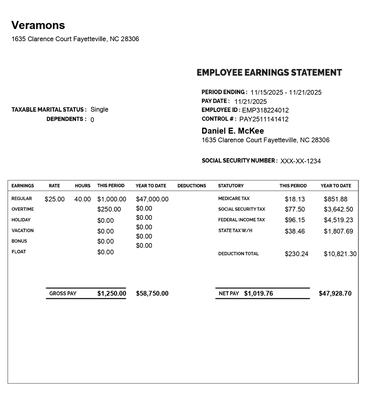

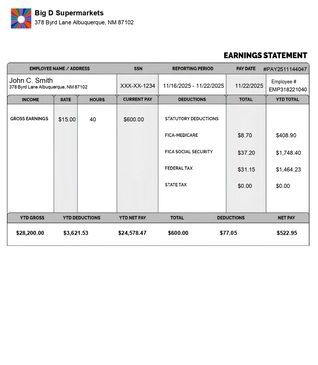

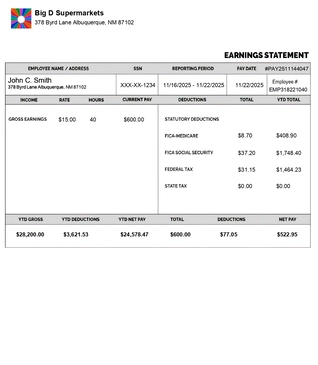

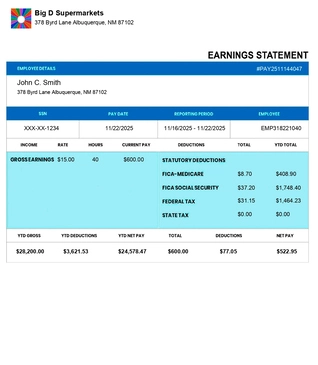

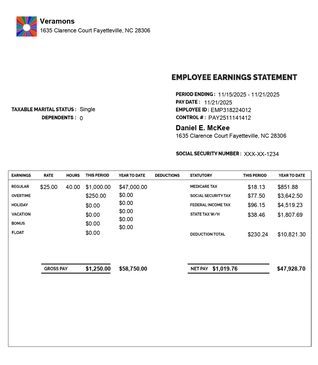

Word Template

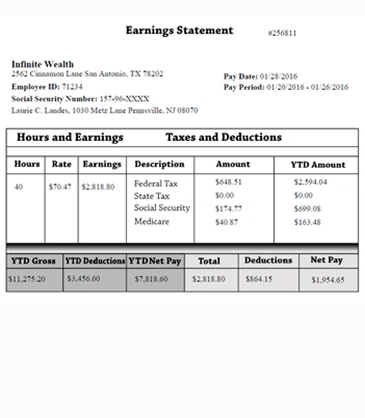

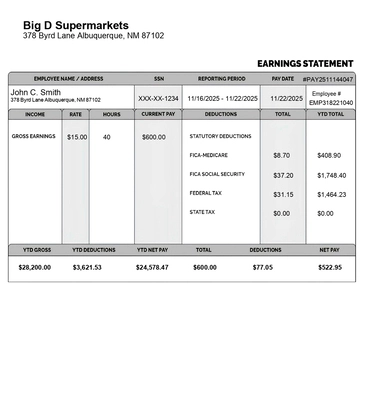

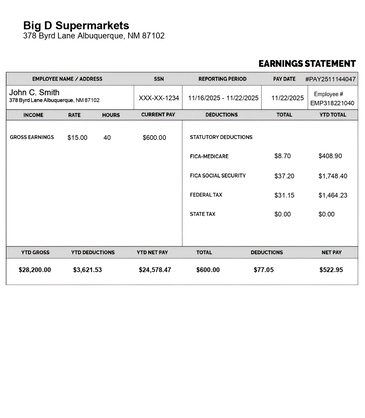

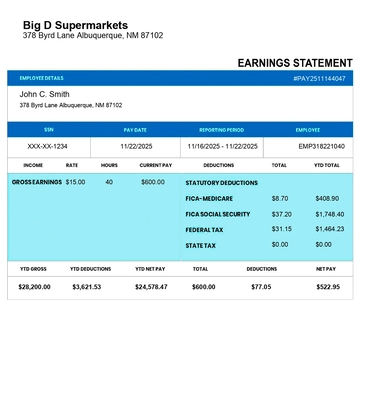

Download the Word paystub template and open it in Microsoft Word. Enter your company and employee details, including pay period and payment date. Fill in hours worked, pay rate, and any deductions or taxes. Review the totals carefully, then save or print the paystub for your records.

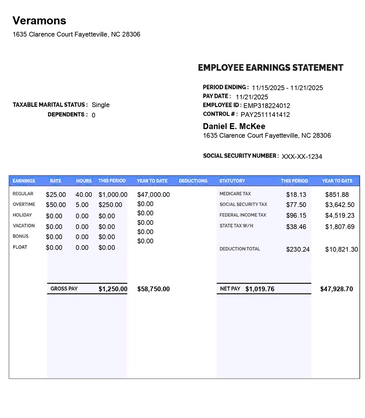

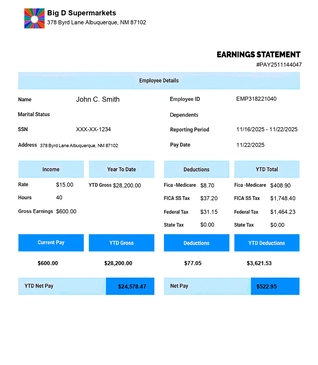

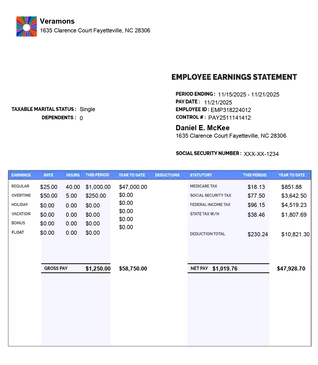

Download WordExcel Template

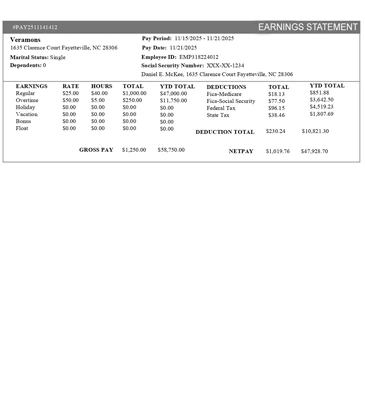

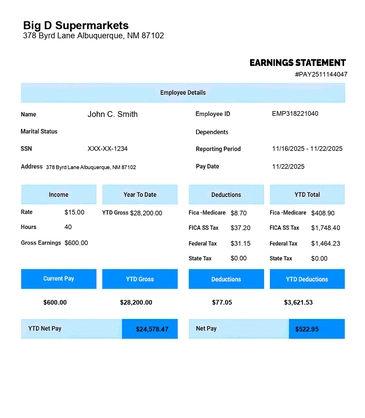

Download the Excel paystub template and open it in Microsoft Excel. Enter your company and employee information, then input hours worked, pay rate, and deductions. The built-in formulas automatically calculate totals and net pay. Review the results and download or print your paystub.

Download ExcelProfessional Paystub Templates – Accurate, Fast & Legal

Payroll management is a critical task for businesses, freelancers, and employees for USA. Professional paystub templates simplify this process. They ensure accuracy, legal compliance, and efficiency. Whether you are submitting a proof of income, maintaining employee pay records, or tracking earnings for tax purposes, our templates are designed to meet all needs.

Our templates are easy to use, downloadable in PDF, Word, and Excel formats, and fully editable. Each template includes all essential payroll elements like gross pay, net pay, deductions, and payroll taxes, ensuring your documentation is accurate and ready for verification.

Using a template reduces human errors, standardizes payroll across multiple employees, and creates a professional look for official submissions. Templates also improve credibility with banks, landlords, or government agencies when employees need proof of income.

Why Businesses & Employees Choose Our Paystub Templates

USA, companies and individuals trust our templates for reliability and professionalism. Here’s why:

Legal Compliance

Templates follow IRS and labor standards, ensuring your payroll is compliant.

Customizable Formats

Available in PDF, Word, and Excel, you can choose the format that fits your workflow.

Editable Fields

Update company information, employee details, and salary amounts with ease.

Professional Appearance

Clean, clear, and structured layouts suitable for submission to institutions.

Time-Saving

Generate multiple paystubs in minutes instead of hours.

Why use a pay stub template?

Templates save time, reduce errors, and provide verified proof of income.

Who can benefit from paystub templates?

Small businesses, freelancers, contractors, remote workers, and employees needing proof of income can all use them.

Templates also help with payroll audits, employee verification, and financial reporting. A standardized format ensures that payroll is consistent and easy to review.

Our Complete Library of Paystub Templates

We offer a comprehensive range of paystub templates suitable for all users.

Free Paystub Templates (PDF, Word, Excel)

Our free templates are perfect for individual employees, freelancers, and small businesses. Download and start generating accurate pay stubs in minutes.

Fillable & Editable Templates

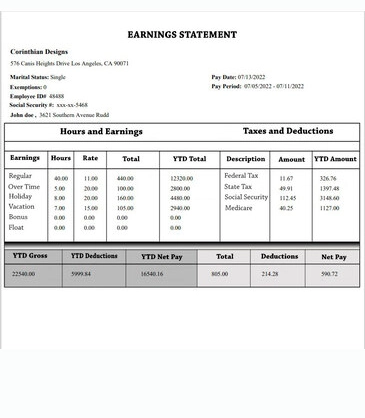

Editable fields allow you to input company info, employee details, and income information. Adjust fields as necessary to accommodate different pay structures.

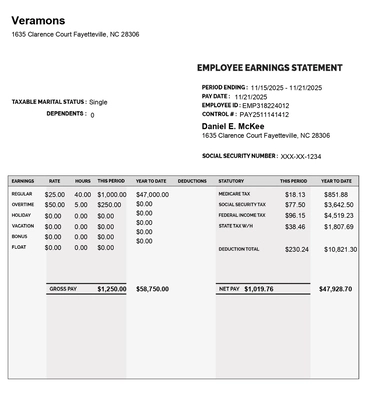

Templates with Calculators

Templates with built-in calculators automatically compute gross and net pay, taxes, and deductions. This reduces manual errors and ensures accuracy.

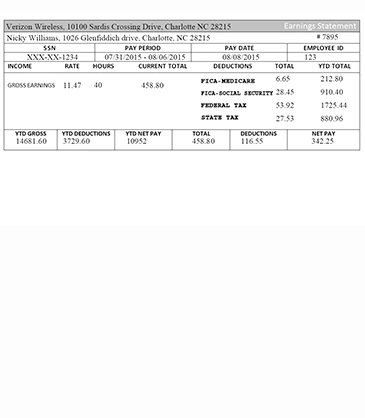

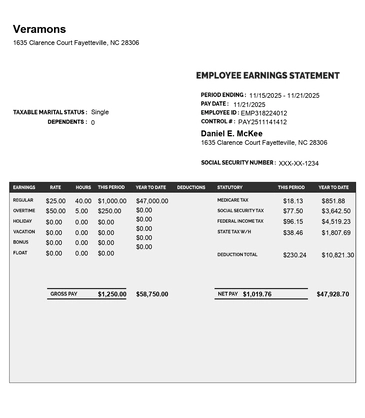

Printable Templates for Employees & Contractors

Print-ready templates make it easy to submit proof of income for applications such as loans, visas, or rentals. The templates are clear, professional, and globally accepted.

Do templates include deductions and taxes? Yes. Templates account for gross pay, net pay, deductions, taxes, and optional benefits.

Tip: Use Excel templates for batch payroll to save time when managing multiple employees.

How to Select the Right Paystub Template

Selecting the right template is essential for accuracy and legal compliance.

Include Company Info & Logo

Always include company name, address, and logo. Templates with logos look professional and are accepted by institutions.

Employee Details & Income Information

Include employee name, ID, position, pay period, and salary. Accurate details ensure proper proof of income.

Deductions & Payroll Taxes

Include taxes, insurance, and benefits. Templates can accommodate federal, state, or local tax variations.

Layout & Design Choices

Choose colors, font, and formatting for clarity. Professional and readable layouts improve verification efficiency.

Are these templates legal for proof of income? Yes. Our templates comply with global payroll standards and IRS guidelines.

Tip: Businesses can use a single template type for all employees to maintain consistency.

Types of Paystub Templates We Offer

We provide templates for various employment scenarios and countries:

Basic Stub Templates

Simple, clean layouts for standard employee payrolls. Ideal for small businesses and contractors.

Spreadsheet Stub Templates

Excel or Google Sheets templates allow batch processing and calculations for multiple employees.

Contractor Paystubs

Templates with or without Year-to-Date (YTD) calculations for freelancers or temporary workers.

Electronic Paystub Templates

Designed for digital submission or storage. Easily emailed or stored in HR systems.

Sample Templates for Different Countries or States

Our templates are adaptable to local compliance rules globally, supporting multiple currencies and tax rules.

Can I edit and customize templates? Yes. Every template is fully editable to fit company and local regulations.

Mini Case Example:

A freelancer in USA can use our Excel template to calculate gross pay, deductions, and net pay, then export as a PDF for proof of income.

Step-by-Step: How to Create a Paystub Using Our Templates

Creating a paystub is simple with our step-by-step guide:

-

1

Select a Template

Pick the format (PDF, Word, Excel) suitable for your needs.

-

2

Add Company & Employee Info

Include your company details, employee name, position, ID, and pay period.

-

3

Input Income & Deductions

Add salary, hourly wages, bonuses, overtime, taxes, and benefits.

-

4

Customize Layout

Adjust fonts, colors, and add your logo to match your company style.

-

5

Download or Print

Save as PDF, Word, or Excel. Print or send digitally.

How do I create a pay stub template with a calculator? Use Excel templates with built-in formulas for automatic gross and net pay calculation.

Tip: Keep a master copy of each paystub to simplify audits and payroll reconciliation.