You’re standing at the edge of a new chapter. A new apartment. A new neighborhood. A fresh start. But just when everything feels exciting, the landlord asks a simple question:

“Can you provide your recent paystubs?”

Suddenly, uncertainty creeps in. What exactly do they want? How many paystubs are enough? What if you’re self-employed or lost your originals?

Take a deep breath. You’re not alone—and this guide is written for you.

Why Paystubs Matter When You Rent an Apartment

When you apply for an apartment, landlords aren’t trying to make life difficult. They simply want reassurance. A paystub is proof that:

- You earn consistent income

- You can afford monthly rent

- Your job is legitimate and ongoing

In most cases, landlords use paystubs to confirm that your income is at least 2.5 to 3 times the monthly rent.

For example, if rent is $1,200, they expect your monthly income to be around $3,000–$3,600.

What Landlords Look for in Your Paystub

When you hand over your paystub, landlords usually focus on a few key details:

- Employee name (must match your ID)

- Employer name and address

- Pay period dates

- Gross income

- Net income

- Year-to-date earnings

If you want to see how a clean, professional stub looks, you can view a real example here:

View a Sample Paystub for Apartment Rental

How Many Paystubs Do You Need?

Most landlords ask for:

- Last 2 paystubs (bi-weekly employees)

- Last 1 month of paystubs (weekly employees)

- Last 2–3 months (self-employed or contract workers)

If you’re self-employed, don’t panic. You can still qualify by providing:

- Generated paystubs

- Bank statements

- Tax documents

How to Create a Free Paystub Using MS Word

Let’s say you don’t have access to your original paystubs. You can create one manually using Microsoft Word.

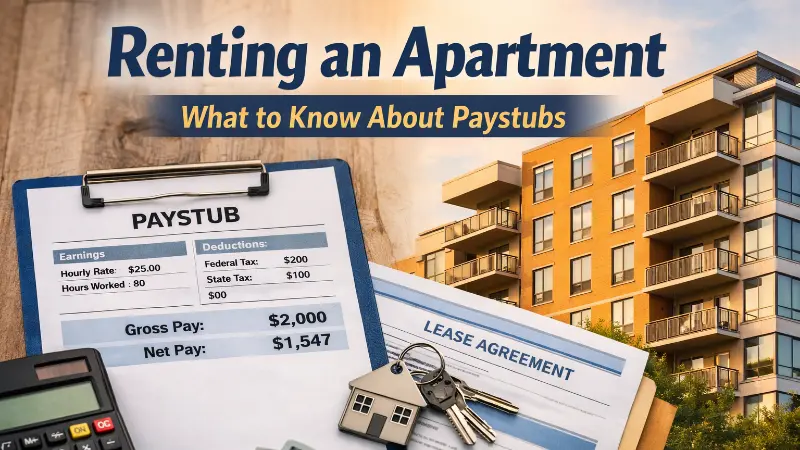

Step-by-Step Example (With Calculations)

Employee Name: Daniel Harris

Employer: BlueSky Marketing LLC

Pay Period: June 1 – June 15, 2025

Pay Frequency: Bi-Weekly

Income Details

- Hourly Rate: $25

- Hours Worked: 80

Gross Pay Calculation:

$25 × 80 hours = $2,000

Deductions

- Federal Tax (10%): $200

- State Tax (5%): $100

- Social Security (6.2%): $124

- Medicare (1.45%): $29

Total Deductions:

$200 + $100 + $124 + $29 = $453

Net Pay:

$2,000 − $453 = $1,547

In MS Word, you simply:

- Create a table (2 or 3 columns)

- Add headings like “Earnings” and “Deductions”

- Format currency properly

- Save as PDF

While this works, manual creation increases the risk of formatting errors.

A Faster & Safer Option: Online Paystub Generator

If you want accuracy, speed, and professional formatting, using an online generator is the smartest option.

With a tool like:

You can:

- Auto-calculate taxes

- Add company logo

- Choose pay frequency

- Download landlord-ready PDFs

This saves time and helps avoid mistakes that could delay your apartment approval.

Common Questions Renters Ask About Paystubs

Can I rent without paystubs?

Yes, but it’s harder. Some landlords accept bank statements or offer letters, but paystubs are still the most trusted proof.

Do landlords verify paystubs?

Sometimes. They may call your employer or compare income with bank deposits.

Are generated paystubs legal?

Yes—if the information is accurate and truthful. Never submit false income details.

What if I just started a new job?

You can provide an offer letter along with your first paystub.

Final Thoughts: Rent With Confidence

You deserve a place that feels like home. Paystubs shouldn’t stand in your way—they should support your application.

Whether you create one manually in Word or use a professional generator, what matters most is accuracy, clarity, and honesty.

Now you know exactly what landlords expect—and how to deliver it with confidence.

Your next apartment is closer than you think.